What Is a “Subject-To” Deal, Offer or Contract?

What Is a “Subject-To” Deal, Offer or Contract?

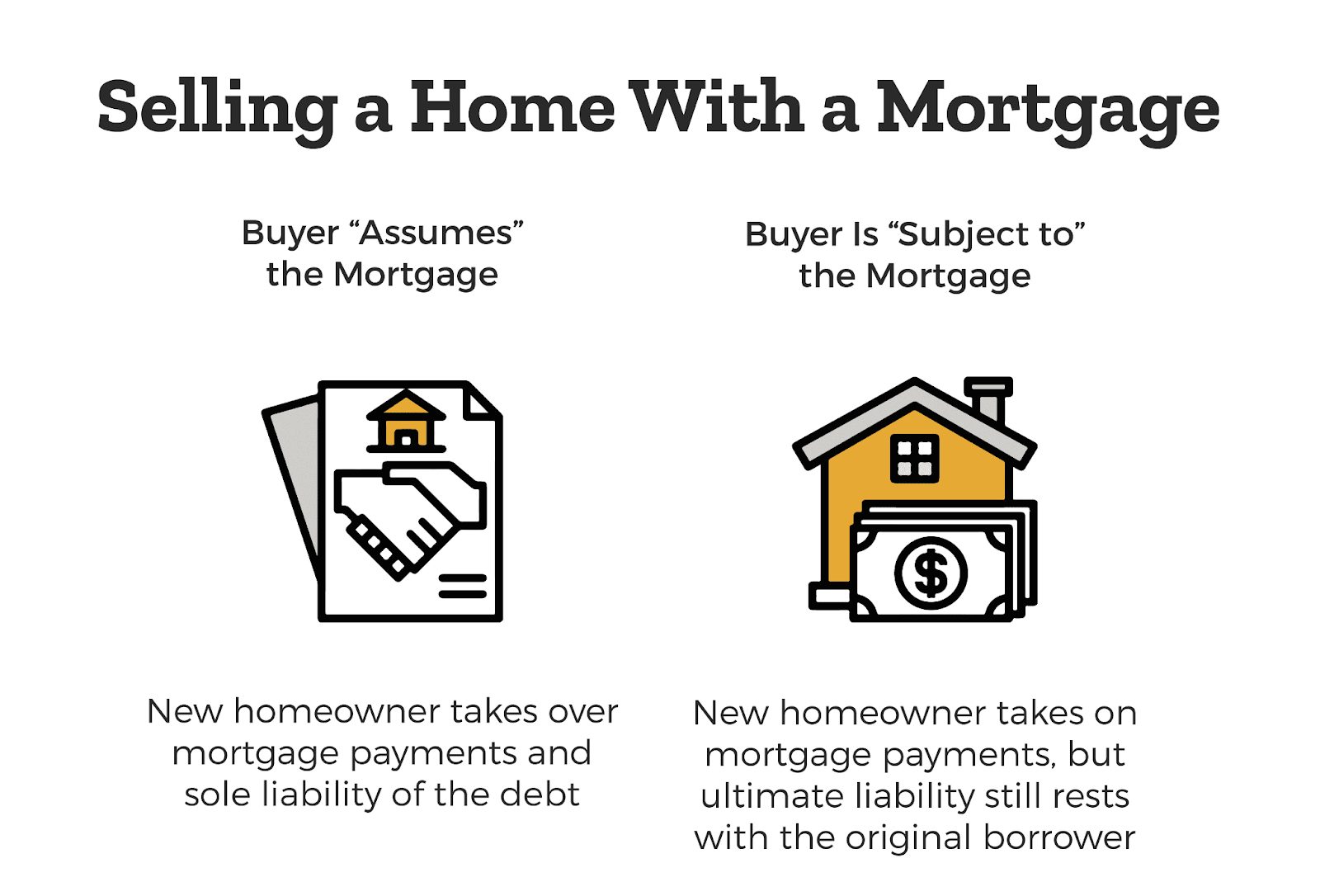

A “subject-to” deal is when a buyer takes ownership of your home subject to your existing mortgage remaining in your name but paid by the buyer and in most cases combined with a seller financing if the buyer needs to cover equity, closing costs or other acquisition fees.

Think of it like this:

🏡 The buyer gets the deed (ownership).

📑 Your loan stays in your name.

💵 The buyer promises to make your mortgage payments.

Why Sellers Sometimes Say Yes

These offers can sound attractive for a few reasons:

✅ Quick takeover without waiting for bank approval

✅ Less hassle compared to a traditional sale

✅ Relief if you’re behind on payments

The Risks You Need to Understand

Here’s where caution is needed: ⚠️ Your loan stays in your name and you’re still legally responsible ⚠️ If the buyer stops paying, your credit gets damaged ⚠️ The bank can call the loan due under the “due-on-sale” clause at any point in time.

Why It’s Legal, But Risky

“Subject-to” deals are legal in all 50 states. But your mortgage agreement gives the lender certain rights, and if they choose to enforce them, the seller may be left scrambling.

The Bottom Line for Sellers

“Subject-to” offers are not scams. They’re tools that some investors use that come with real risks.

👉 Before you sign any real estate contract, make sure you’ve spoken to a Realtor, specialized attorney or CPA who can protect your interests.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

What Is a “Subject-To” Deal, Offer or Contract?

What Is a “Subject-To” Deal, Offer or Contract?